Your Dream Home Is Closer Than You Think. Get Approved for the Right Loan, Fast.

Skip the stress, skip the confusion. At Home Loans by Tera, we match you with the best loan options for your budget and lifestyle – all with a simple, transparent process.

Buying or Refinancing Doesn’t Have to Be Complicated

If you’ve been searching for a home loan, you’ve probably noticed:

Confusing terms.

Endless paperwork

Uncertainty about what you really qualify for.

The fear of choosing the wrong loan and paying thousands more than necessary.

That ends here.

At Home Loans by Tera, we believe getting a mortgage should be simple, clear, and tailored to you. Whether you’re buying your first home, upgrading, or refinancing to save money, we’ll guide you every step of the way.

Why Homeowners Choose Tera Sommer

With a solid background in mortgage, I make sure you understand every step, keeping things simple and stress-free. As a broker, I have a huge network of lenders to choose from to find the best loan for your specific real estate purchase needs! Let's chat and get you financially equipped to purchase!

Personalized Loan Options – We shop multiple programs to find the right fit.

Fast Approvals – Close in as little as 30 days.

All Loan Types Available – Conventional, FHA, VA, USDA, Jumbo & more.

Local & Trusted – Licensed, transparent, and committed to your success.

Stress-Free Process – Clear communication and guidance from start to finish.

Flexible Loan Programs for Every Situation

No two homeowners are the same. That’s why we offer a full range of mortgage solutions:

We know how to get you exactly the right mortgage

From fast, custom digital quotes to a completely streamlined online loan application and approval process, you can be well on your way to home ownership, usually in less than 30 days.

Home Purchase Loans – Fixed & adjustable rate mortgages, conforming loans, jumbo & super jumbo.

Refinance Loans – Reduce your rate, lower monthly payments, or cash out equity.

Special Programs – FHA, VA, USDA – tailored to unique borrower needs.

How It Works

(It’s Simpler Than You Think)

3 Easy Steps:

Apply Online in Minutes

Share a few details to start your free quote.

Review Your Options

We present the best mortgage programs for your needs.

Get Approved & Close

With expert guidance, you’re ready to move forward with confidence.

Available Mortgage Loan Types

Fixed Rate Mortgage

A Fixed Rate Mortgage is the go-to choice for those who value stability and predictability in their financial planning. With this type of mortgage, your interest rate stays the same throughout the entire loan term, whether it's 15, 20, or 30 years, ensuring your monthly payments never change.

It’s perfect for setting down roots and budgeting with peace of mind, especially if you're planning to stay in your home for the long haul.

Adjustable Rate Mortgage (ARM)

An Adjustable Rate Mortgage, or ARM, starts you off with a lower interest rate that's locked in for a set initial period, making it an attractive option for those looking to save upfront.

However, after this honeymoon phase, the rate fluctuates with market trends, meaning your payments can go up or down. It's a bit of a gamble, but it can be a smart move if you're planning to sell or refinance before the rate adjusts, or if you're expecting your income to increase in the future.

FHA Loan

This is a fantastic option for first-time homebuyers or those without a lot of cash for a hefty down payment, offering down payments as low as 3.5% and being more lenient on credit scores.

But here's the catch: You'll be paying for PMI, or Private Mortgage Insurance, for the life of the loan, which adds to your monthly costs. It's a trade-off for easier entry into homeownership, especially if your financial past has a few blemishes.

VA Loan

A VA Loan is like a thank-you note from Uncle Sam to our veterans and active military, offering some of the best perks in the mortgage world. With no down payment required, no PMI, and typically lower interest rates, it's a fantastic deal for those who have served.

Just remember, there's a VA funding fee, but considering the benefits, it's a small price to pay for those who've given so much.

USDA Loan

This is like a hidden gem for those looking to plant roots in rural or certain suburban areas, often overlooked but incredibly valuable. With zero down payment required and lower interest rates, it’s a great option if you meet the geographical and income criteria.

Just a heads up, though – you'll need to pay a guarantee fee, similar to PMI, but the overall affordability makes it a sweet deal for qualifying homebuyers. Keep in mind that income from everyone in the household will be included in order to qualify.

Jumbo Loan

A Jumbo Loan steps in when you're eyeing a property that's a bit more, let's say, 'grand' than your average home, exceeding the conventional loan limits set by Fannie Mae and Freddie Mac.

These loans come with their own set of rules – think higher credit scores, larger down payments, and a more rigorous underwriting process. It's the high-stakes game of the mortgage world, ideal for luxury properties or expensive housing markets, but you'll need to bring your A-game to qualify.

Interest-Only Loan

An Interest-Only Loan is a bit like a tightrope walk in the mortgage world – it offers lower initial payments because you're only paying the interest for the first few years. It's a nifty option if you're expecting a future cash windfall or planning to sell before the balloon payment hits.

But tread carefully, as once the interest-only period ends, you're looking at higher payments since you'll start paying down the principal.

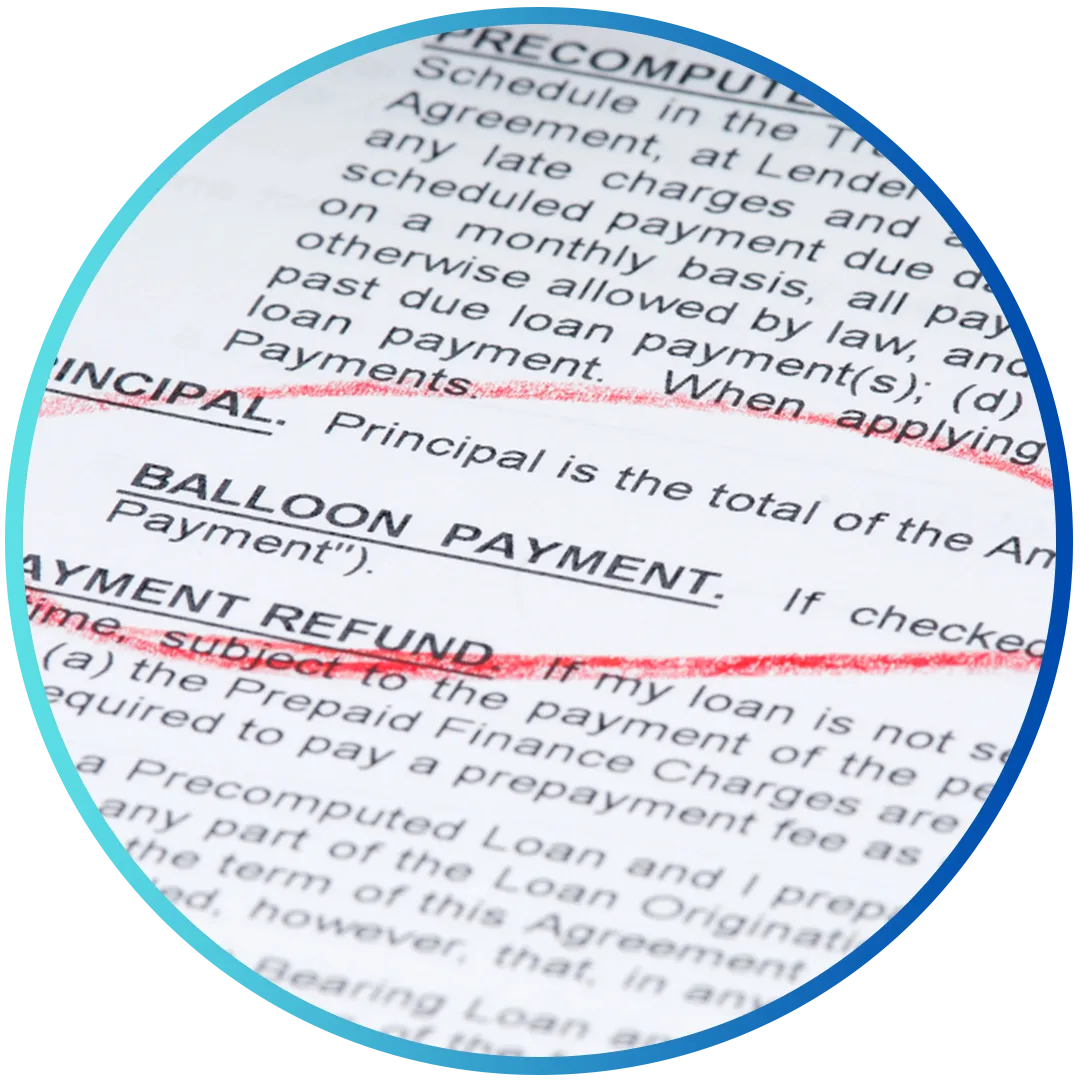

Balloon Mortgage

This is kind of like a short-term fling with long-term consequences – you get lower monthly payments for a set period, typically 5 to 7 years, but then comes the big catch: a large 'balloon' payment at the end. It's a gamble that can pay off if you plan to sell or refinance before the balloon payment is due.

But be warned, if your plans don't pan out, you could be facing a hefty sum to pay off all at once.

Reverse Mortgage

A Reverse Mortgage flips the script on traditional home loans – instead of you paying the lender, the lender pays you, based on your home's equity. It's a nifty option for seniors over 62, turning their home equity into cash without having to sell.

Just keep in mind, the loan comes due when you move out, sell, or the last borrower passes away, so it's a choice that needs careful consideration for the long-term impact on your estate.

Construction Loan

A construction loan is a short-term, higher-interest loan that provides the funds necessary to build a residential property. Unlike a traditional mortgage, it covers the cost of building a home and is usually converted into a regular mortgage after construction is complete.

It's perfect for those looking to build their dream home from scratch, but keep in mind, it requires detailed plans and a reputable builder – it’s not your average home buying process!

Renovation Loan (203K FHA)

This type of mortgage is offered by the Federal Housing Administration (FHA) and allows homebuyers and homeowners to finance both the purchase (or refinancing) of a house and the cost of its rehabilitation through a single mortgage.

Interest rates can be a bit higher with these types of loans. They're great for turning a fixer-upper into your dream home, but it requires careful planning and understanding of the process.

What Our Clients are Saying:

Frequently Asked Questions (FAQs)

● What is the best type of mortgage for my situation?

Fixed Rate or ARM? Fixed-rate mortgages offer the security of a constant interest rate and monthly payment for the life of the loan, ideal for those who plan to stay in their home long-term. In contrast, adjustable-rate mortgages start with a lower interest rate that can change over time, potentially beneficial for short-term homeowners but with the risk of future rate increases.

● How much can I afford to borrow?

Determining how much you can borrow for a mortgage hinges on your income, existing debt, and credit score, as lenders use these factors to assess your ability to repay the loan. This evaluation is vital as it helps ensure that you take on a mortgage that aligns with your financial capacity, avoiding overextension and potential future financial strain.

● What is the minimum down payment required?

The minimum down payment required for a mortgage varies depending on the loan type and the lender's policies, with options sometimes as low as 3-5% of the home's purchase price. For certain loans, like VA and USDA loans, borrowers may even qualify for zero down payment, but typically, a larger down payment can lead to better loan terms and lower interest rates.

● What credit score do I need to qualify for a mortgage?

The credit score needed to qualify for a mortgage is crucial as it affects both loan approval and interest rates; generally, a higher credit score means better terms. While the minimum score required varies by loan type and lender, typically scores around 620 are needed for conventional loans, but some government-backed programs may allow lower scores, as low as 500.

● What are the current mortgage rates?

Rates are subject to change based on market conditions and can significantly impact the overall cost of a loan, making it essential for borrowers to stay informed. These rates vary by loan type, term, and lender, influencing monthly payments and the total interest paid over the life of the mortgage, thus affecting affordability and budgeting decisions for homebuyers.

● What are all the costs involved in getting a mortgage?

There are various costs beyond the principal and interest payments. These include origination fees charged by the lender for processing the loan, appraisal fees for evaluating the home's value, title insurance to protect against ownership disputes, and closing costs, which cover a range of administrative and legal services.

Additionally, borrowers might also need to pay for private mortgage insurance (PMI) if their down payment is less than 20%. Make sure you account for ongoing property taxes and homeowners insurance. Understanding these expenses is crucial for homebuyers to accurately budget for the true cost of purchasing a home.

● How do I get pre-approved for a mortgage?

Getting pre-approved for a mortgage is a crucial first step in your home-buying journey. It involves a lender reviewing your financial information, like your income, debts, and credit score, to determine how much they're willing to lend you. This not only gives you a clear idea of your budget but also shows sellers that you're a serious and qualified buyer, which can be a significant advantage in competitive housing markets. CLICK HERE TO GET PRE-APPROVED!

● How long does the mortgage application process take?

The mortgage application process duration varies, typically taking anywhere from a few weeks to a couple of months, depending on the complexity of your financial situation and the lender's efficiency. This timeframe includes steps like gathering financial documents, property appraisal, and the lender's underwriting process to approve the loan. The sooner you can gather all the required documents and get them to your lender, the faster the process can go.

● Can I qualify for any government-backed mortgage programs?

Certain government-backed mortgage programs are designed to help specific groups of homebuyers, offering advantages like lower down payments, more lenient credit requirements, or favorable terms. For example, FHA loans are great for first-time buyers or those with lower credit scores, VA loans offer benefits for veterans and service members, including no down payment options, and USDA loans are aimed at buyers in rural or certain suburban areas, often with no down payment required. Understanding if you qualify for these programs can open up more affordable and accessible paths to homeownership. Your lender can let you know which program is best for your unique situation.

● What documents do I need to apply for a mortgage?

When applying for a mortgage, lenders require a range of documents to assess your financial health and determine your eligibility for a loan. It is important to have these ready when you are looking to get pre-approved, as we will need proof of your financial situation in order to issue an actual pre-approval. These documents typically include:

- Proof of Income: Pay stubs for the last 30 days, W-2 forms for the last 2 years, and possibly your tax returns from the last two years.

- Proof of Employment: Employers' contact information for the last two years.

- Credit Information: Permission for the lender to run a credit check.

- Bank Statements: Be prepared to show the last two months' worth of bank statements to verify savings and consistent income. These can be found in your online account. We need complete documents, including the last page, which is usually empty.

- Identification: Government-issued ID, like a driver's license or passport.

- Investment Account Statements: If applicable, to show additional assets.

- Renting History: Rental payment history and landlord contact information, if currently renting.

- Other Documents: Any other documentation related to your financial situation, like divorce decrees or bankruptcy paperwork, if applicable.

Want to Save Thousands

on Your Mortgage?

Click below to get customized information for YOUR specific needs!

Rates are changing, don’t miss out on savings. Mortgage rates fluctuate daily. Locking in at the right time could save you thousands over the life of your loan. Don’t wait until it’s too late.

Tera Sommer NMLS #2115126

P1 NMLS #1862063